2025 Roth Ira Deadline. The ira contribution limits for 2025 are the same as for 2025. The roth ira income limit to make a full contribution in 2025 is less than $150,000 for single filers, and less than $236,000 for those filing jointly.

If you’re a single filer,. The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

Roth Ira 2025 Contribution Deadline Dru Wenonah, You cannot deduct contributions to a roth ira.

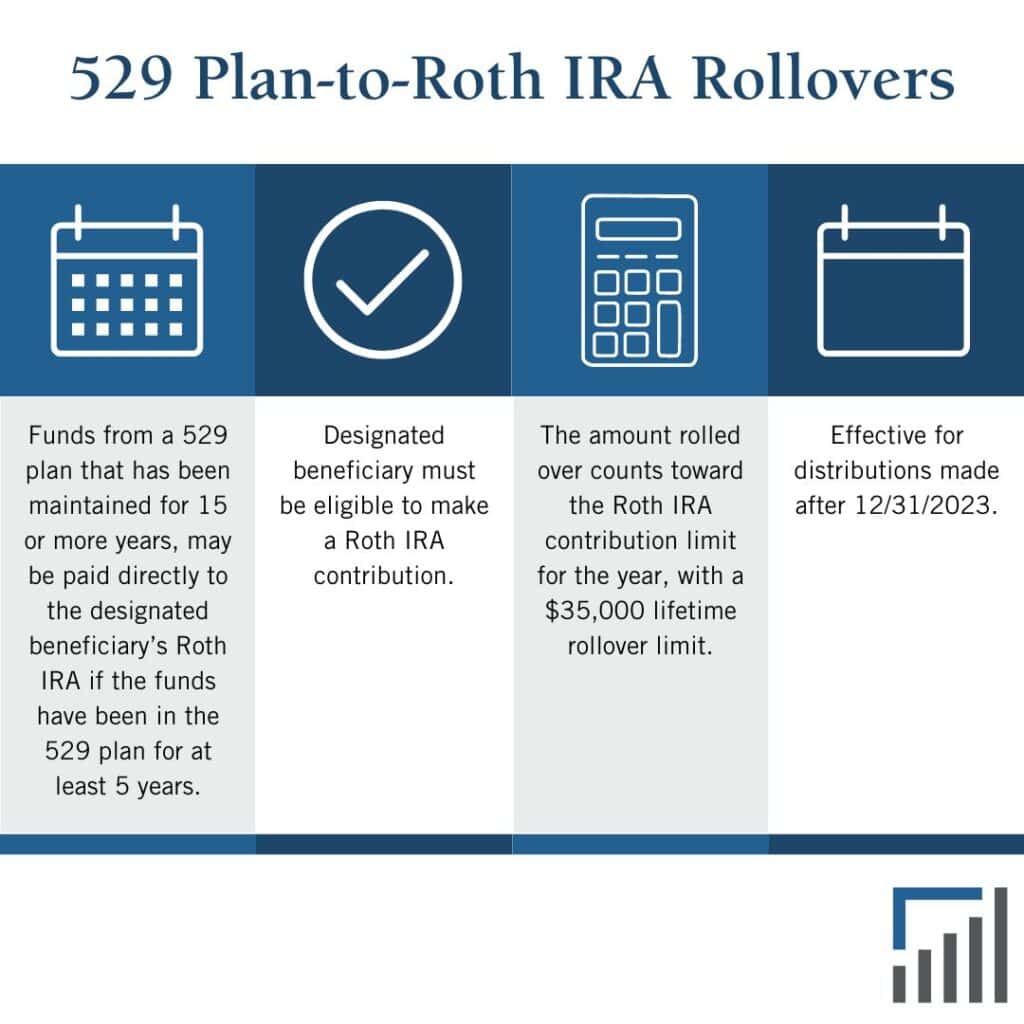

529 Rollover To Roth Ira 2025 Deadline Victor James, In 2025, you can contribute a total of up to $7,000, or $8,000 if you’re age 50 or older, to all of your roth and traditional ira accounts.

Roth Ira 2025 Contribution Deadline Dru Wenonah, Don't forget you can open and contribute to a 2025 roth ira until the due date of your 2025 tax return on tuesday april 15, 2025.

Roth Ira 2025 Deadline Thea Lilllie, The irs has yet to announce 2025 retirement account contribution limits.

_into_a_Roth_IRA-1.png?width=3360&height=1890&name=Signs_to_Roll_your_401_(k)_into_a_Roth_IRA-1.png)

Roth Ira 2025 Deadline Thea Lilllie, The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

Roth Ira Limits 2025 Arden Sorcha, With taxes poised to rise for many after the trump tax cuts expire in 2025, it may make sense for many savers to consider a roth ira conversion while the tax situation is more.

Roth Ira Limits 2025 Arden Sorcha, Based on recent inflation figures, we can get a good idea of what to expect, but we haven't officially.